Table of Contents

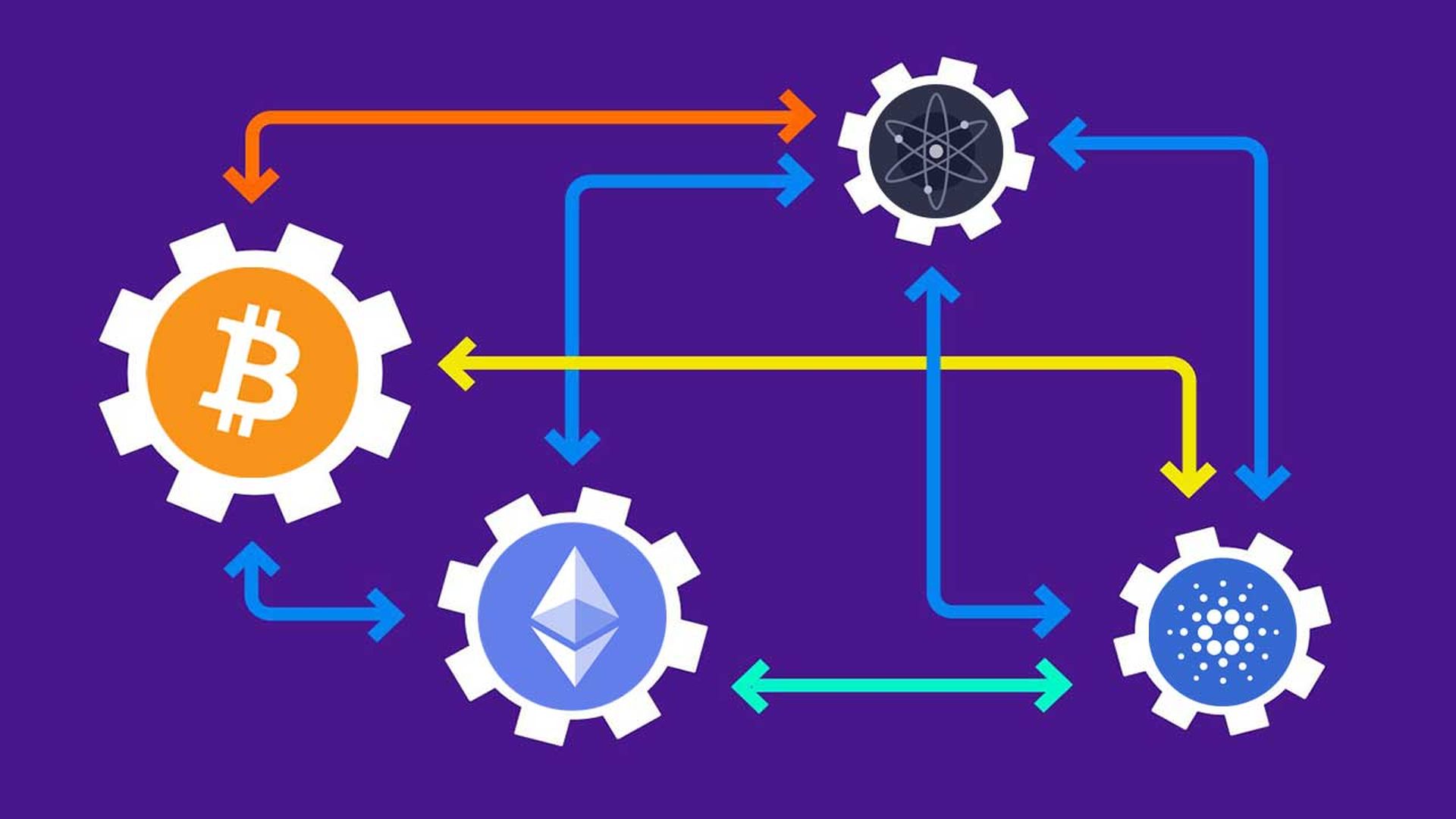

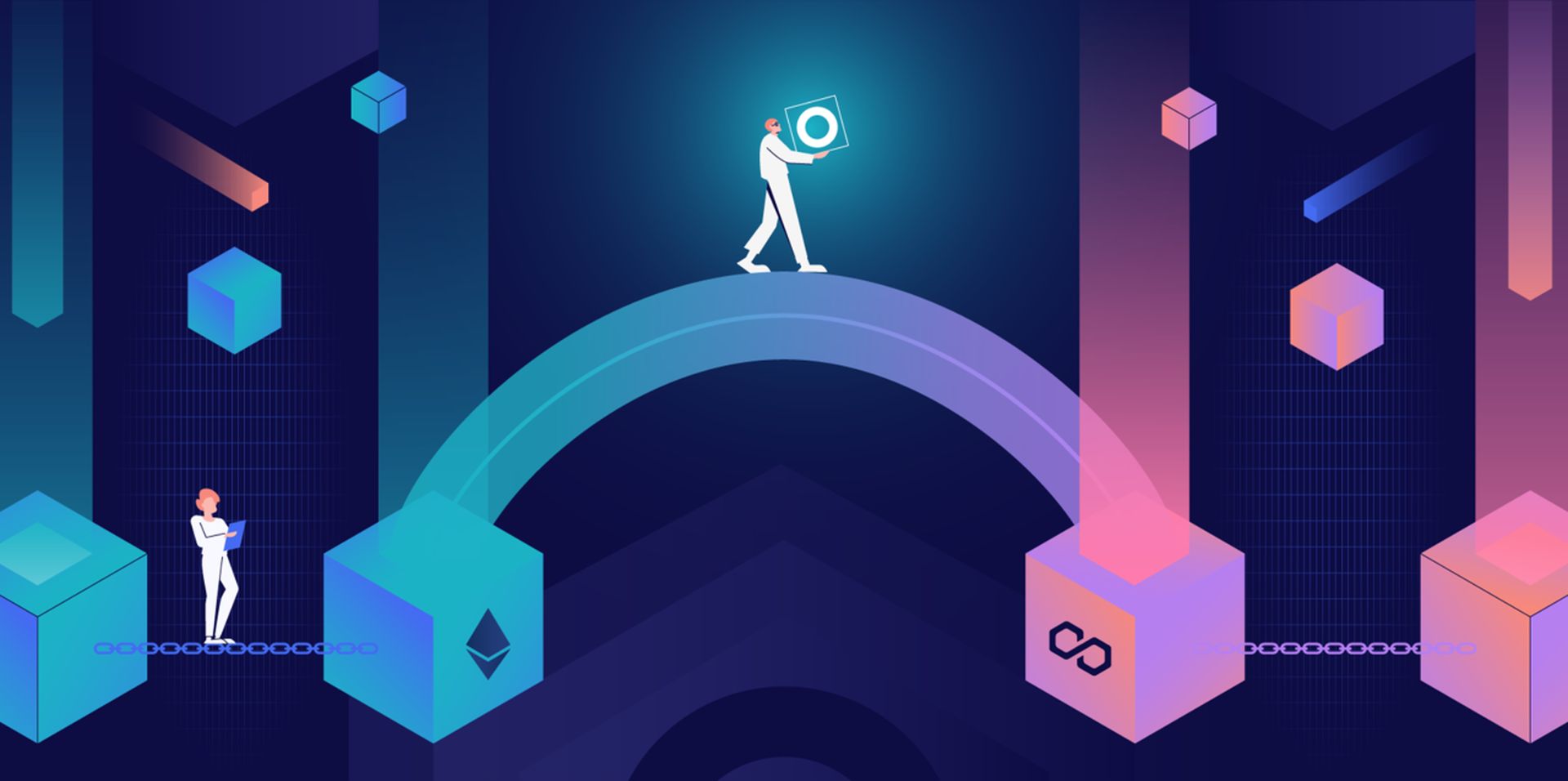

One of the biggest problems with blockchains is a lack of interoperability. Blockchain bridges, also known as cross-chain bridges, are technologies that enable you to migrate assets from one blockchain to another. Due to the fact that blockchain assets are frequently incompatible, bridges produce synthetic derivatives that stand in for an asset from another network.

One Solana currency will be “wrapped” via a bridge into a token depending on the target blockchain and sent to an Ethereum wallet if you use a bridge to transmit it there. In this situation, the Ethereum wallet would receive a “bridge” version of Solana that has been converted to an ERC-20 token – the generic token standard for fungible tokens on the Ethereum blockchain.

Bridges enable new marketplaces and advance a multi-chain future, but they also present security risks, as demonstrated by a massive $326 million exploit on the nascent Wormhole bridge in February 2022.

Types of blockchain bridges

Some bridges, referred to as unidirectional or one-way bridges, only let asset porting to the target blockchain; they do not provide asset porting in the opposite direction. For instance, Wrapped Bitcoin enables the conversion of BTC into an ERC-20 stablecoin by allowing you to send bitcoin to the Ethereum blockchain, but it does not permit the transfer of ether.

You can freely transfer assets to and from blockchains using other bridges that are bidirectional, or two-way, such as Wormhole and Multichain. You can send ether to Solana in the same way that you can send Solana to the Ethereum blockchain.

Some bridges, referred to as unidirectional or one-way bridges, only let asset porting to the target blockchain; they do not provide asset porting in the opposite direction. For instance, Wrapped Bitcoin enables the conversion of BTC into an ERC-20 stablecoin by allowing you to send bitcoin to the Ethereum blockchain, but it does not permit the transfer of ether.

You can freely transfer assets to and from blockchains using other bridges that are bidirectional, or two-way, such as Wormhole and Multichain. You can send ether to Solana in the same way that you can send Solana to the Ethereum blockchain.

Why should you use blockchain bridges?

Transferring assets from one blockchain to another has a wide range of advantages. First, the blockchain onto which you migrate assets may be less expensive and quicker than it. This is undoubtedly the case for Ethereum, where high transaction costs and sluggish throughput make it challenging for beginners to participate in decentralized banking (DeFi).

Investors could trade ERC-20 tokens for a fraction of the price without giving up exposure to Ethereum tokens if they migrated assets to a layer 2 network, a quicker blockchain that sits atop the Ethereum blockchain, like Arbitrum or Polygon.

Bridges could be used by other investors to take full advantage of marketplaces that are restricted to a different blockchain. For instance, the DeFi protocol Orca, which supports a wrapped version of ETH, is only available on Solana.

The utilization of bridges is becoming simpler. Many DeFi protocols contain built-in bridges that enable users to exchange tokens between protocols without leaving the site. As a result, converting tokens over bridges is made simpler.

What are the biggest blockchain bridges?

DeFi Llama estimates that as of March 2022, $21.8 billion of crypto was trapped in bridges. Wrapped Bitcoin, the largest blockchain bridge with $10.2 billion in total value locked, accounts for over half of the bridge market (TVL). With nearly $7 billion in TVL, DeFi Llama rates Multichain as the biggest blockchain bridges.

According to a dashboard on Dune Analytics, the Avalanche Bridge, which has roughly $6 billion in TVL, is the largest Ethereum bridge, followed by Polygon ($5 billion TVL) and the Fantom Anyswap Bridge ($4.2 billion TVL).

Are blockchain bridges safe?

Your money is in danger with cryptocurrency in general. Even those unique decentralized bridges that have been tested are vulnerable to vulnerabilities because some of them are still relatively unexplored. Wormhole is the most known recent instance, however a week prior to that attack, a bridge called Qubit was taken advantage of for $80 million.

Wormhole allowed the attacker to manufacture 120,000 worth of wrapped Ethereum without having to stake any ETH, according to research from blockchain analytics company Elliptic. After that, the attacker withdrew the free WETH. Jump Trading, a high-frequency trading company, covered the losses to save the protocol.

.@JumpCryptoHQ believes in a multichain future and that @WormholeCrypto is essential infrastructure. That’s why we replaced 120k ETH to make community members whole and support Wormhole now as it continues to develop.

— Jump Crypto 🔥💃🏻 (@jump_) February 3, 2022

Several risk profiles exist for trusted bridges. The risk is not that a hacker will use the protocol to drain the company of money, but rather that the company holding the staked assets will be dishonest, careless, or lose control over the assets due to incompetence or due to orders from a third party, such as if the government asks the company to freeze assets.

What does a blockchain bridge do?

Each blockchain network has its own set of guidelines, conventions, tokens, and smart contracts. Although the blockchain network is entirely operational, it operates as a single entity that is constrained to the confines of its own realm. Users will have a lot of trouble with this, especially if the network serves as the foundation of a broader ecosystem. Bitcoin is one such instance; its functionality is restricted to its own network, and its protocol forbids user interaction with other networks.

This barrier is removed via blockchain bridges, which enable data and token transfers between blockchain networks and external networks. Blockchain bridges do this by utilizing wrapped tokens to imitate the features of the destination token in a different network. Let’s imagine you wish to convert Bitcoin (BTC) to the Ethereum network. That Bitcoin will be wrapped in a blockchain bridge and secured by a smart contract. The blockchain bridges produce the same quantity of wrapped BTC in the Ethereum network concurrently. The wrapped BTC can then be converted, and an equivalent amount of BTC will be sent to my wallet on the new network.

What is the best crypto bridge?

Binance Bridge

The well-known Binance Bridge is the top pick among the best blockchain bridges. For facilitating the movement of assets from Ethereum to the Binance Smart Chain, it is a reliable alternative. The Binance Bridge might assist anyone in transforming cryptocurrency tokens into formats compatible with Binance Chain and Act as a reliable Ethereum-Binance Smart Chain bridge.

Avalanche Bridge

The Avalanche Bridge is the next well-known addition to the list of the most well-liked blockchain bridges. It is a two-way cross-chain crypto bridge that connects the Ethereum and Avalanche blockchain networks. The traditional Avalanche-Ethereum Bridge, also known as the AEB, can be replaced by the Avalanche Bridge, also known as the Avax Bridge. The smooth movement of assets between the two networks might be made possible via the Avalanche Bridge, which would promote the expansion of Avalanche.

Synapse Bridge

Synapse Bridge would gain attention if the question “What are the best blockchain bridges?” had an appropriate response. It is a distinct layer-decentralized protocol designed to promote cross-chain cooperation within the DeFi ecosystem. The Synapse AMM and Synapse Bridge are the two key components of the protocol. Using a programmable cross-chain messaging system that supports smart contract calls, multiple assets, and many other features, Synapse connects blockchains.

Multichain Bridge

Multichain Bridge is a promising competitor for promoting blockchain interoperability in the group of cross-chain crypto bridges. Fantom Anyswap was a cross-chain bridge protocol that allowed flexible data and asset exchange between several blockchain networks.

Polygon Bridge

The Polygon Bridge is a standout addition among the greatest cross-chain bridge crypto platforms. For transferring NFTs and ERC tokens to the Polygon sidechain, it is a well-liked crypto bridge. The Plasma Bridge and the Proof of Stake Bridge are two different sorts of bridges that are present in Polygon.

With different security infrastructures, the two bridges can assist in transferring assets between Ethereum and Polygon. To transfer ETH and ERC-20-compliant tokens, for instance, the PoS Bridge uses Proof of Stake consensus and is secure.

Tezos Wrap Protocol

The Tezos Wrap Protocol is the last cross-chain bridge on the list that you ought to employ. It is a decentralized, open-source, and bidirectional cryptocurrency bridge that makes it easier to move assets between the Tezos and Ethereum blockchain networks. For use in the Tezos blockchain ecosystem, the bridge protocol aids in the FA2 tokenization of ERC-20 tokens.

What are cross-chain bridges?

Software programs called blockchain bridges make it possible for transactions to take place between different blockchains. Cross-chain bridges are a crucial component of the process if someone wants to transfer cryptocurrencies, non-fungible tokens (NFTs), or other digital assets between blockchain networks. Although most digital assets are linked to a single blockchain, cross-chain bridges allow for inter-network transactions that support a much larger digital ecosystem. Owners of cryptocurrencies can access the value locked up in their portfolios for a wider range of practical uses by using cross-chain bridges.

Several cutting-edge operations are made possible by blockchain bridges, however, due to the applications’ history of hacker losses, there are security issues with them. Cross-chain bridges are technically complex, therefore it’s better to utilize them only if you know what you’re doing and how they operate in order to avoid unanticipated crypto losses.

Conclusions

- Transactions between blockchain networks are made possible by cross-chain bridges.

- Blockchain bridges software functions with cryptocurrencies and other digital assets.

- Cross-chain bridges are susceptible to security risks including hacking.

Now that you know all there is to know about Blockchain bridges, why not head to some of our other articles, such as when was blockchain created, or what are permissioned blockchains.